Welcome to the most comprehensive and in-depth guide to Credit Repair you'll find on the internet.

The best part?

This list has absolutely EVERYTHING you need to know about Credit Repair.

So if you want the best Credit Repair options for 2023, you'll really love today's guide.

Let's dive in...

- What is Credit Repair?

- Your Credit Rights

- Credit Repair Dispute Letters

- DIY Credit Repair

- Credit Repair Companies and Credit Repair Services

- Fast Credit Repair Options

- Top Credit Repair Companies and Legitimate Credit Repair Companies

- Credit Repair Cost

- Pay Someone to Fix My Credit

- Best Credit Fix

- Steps to Fix My Credit

- Credit Repair Software

- Bonus #1 Advanced Disputing Techniques

- Bonus #2 Do I Need Credit Repair?

Credit Repair Explained (and EXPOSED)

Hey, I'm Joe Mahlow.

I've created this guide to give you the unfiltered truth about Credit Repair so you never have to do an in-depth internet search on how to improve your credit ever again!

With all the conflicting information about Credit Repair floating around, it can be overwhelming trying to sort through it all. Attempting to discern between the Good, the Bad, and the Ridiculous advice you'll hear from "experts" lacking any credentials isn't fun for anyone. That's why I've taken my 15+ years of Credit Repair experience and written this extensive guide just for you. This information will give you the COLD HARD FACTS about Credit Repair.

That said, let's get to it!

What is Credit Repair?

Simple definition: Credit Repair is the process of improving creditworthiness with creditors.

The top three credit bureaus in the U.S. are Experian, Equifax, and TransUnion. A credit bureau collects and researches individual credit information, then sells it to creditors so they can make decisions about granting loans. The companies or agencies that help to legally clean-up bad credit information in order to give a fresh start to the consumers are known as credit repair companies or agencies.

Your Credit Rights

Now that you know what Credit Repair is, now I want you to understand what your rights are when it comes to your personal credit report.

Since repairing your credit is considered a Legal Process, you need to know what you are allowed to do.

You don'tt have to be an attorney or a lawyer or hire someone to do your credit repair for you...

You only need to know the #1 most important Legal Right that you have.

Under the Article 604(b)(3)(B)(i)(IV) of the Fair Credit Reporting Act (FCRA) states that you "...may dispute with the consumer reporting agency the accuracy or completeness of any information in a report."

Anything...

Personal information, account information -- basically any text on a credit report unique to you, you can dispute.

NOW, what I'm about to tell you is what most people will not tell you...

Are you listening?

"You can LEGALLY contest the VALIDITY of any account."

This means that it doesn't matter who, what, where, why, or when this account was opened. What matters is that the Original Creditor CAN provide VALID and VERIFIED PROOF that this account is VALID and TRUE.

Most "Experts" (and even law firms) will tell you to dispute the account and ask them to validate the account...

This is BAD ADVICE.

And in most cases, this is where most people's frustrations begin...

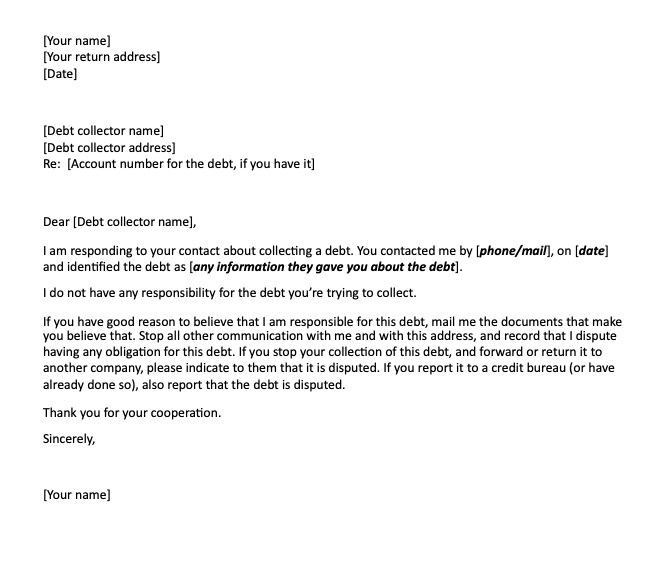

Credit Repair Dispute Letters

Okay, so you're probably saying to yourself "That's great, Joe, I can basically dispute just about anything on my credit report. Sooo...how do I actually DO that?

You're in luck, because I'm going to tell you EXACTLY how to do that: Dispute Letters!

But what is the best dispute letter to send...?

Drumroll, please...

The BEST letter to send is...

NONE!

Well, none of the ones you'll find online, that is. You see, anytime a dispute letter is used, it's scanned and checked for relevance. If the same letter is used numerous times it will be flagged as negligible by the credit bureaus. This means if you keep using these generic letters, you will be blacklisted by the Great Credit Gatekeepers, resulting in your disputes not being read by anyone at all.

Which equals No Results.

"So, what you're saying is: Dispute Letters are the best way to dispute, but I shouldn't use dispute letters? Wait, what?"

Not quite...

The best dispute letters are not ones you will find floating around online. The BEST dispute letters are the ones you create for yourself, right now!

And don'tt worry, it's much easier than what you're thinking!

Before we create the letter, we need to know what the Credit Bureaus are looking for in order to know what to include in your letter.

An effective dispute letter contains the following information the bureaus require in order for them to respond:

- Your Name

- Your Address

- Your DOB

- Your Last 4 of your Social

- Account(s) in Reference

- Account number(s) in Reference

- Reason for disputing the account(s)

- Resolution you want if the account(s) are Not Verified

Ok, so can we write this letter already?!

Yes. BUT first, we've got to address the most important part...

Each item listed above can be found on the credit report. Each item, that is, except for the LAST TWO...

This information will define how successful your disputes will be and thus, where your investigative work will need to begin.

Let's break them down...

#1 Why you are Disputing the Account

After listing the account name and number you'll want to write a small statement explaining why you are disputing this account.

To help you understand this further, refer to the example below:

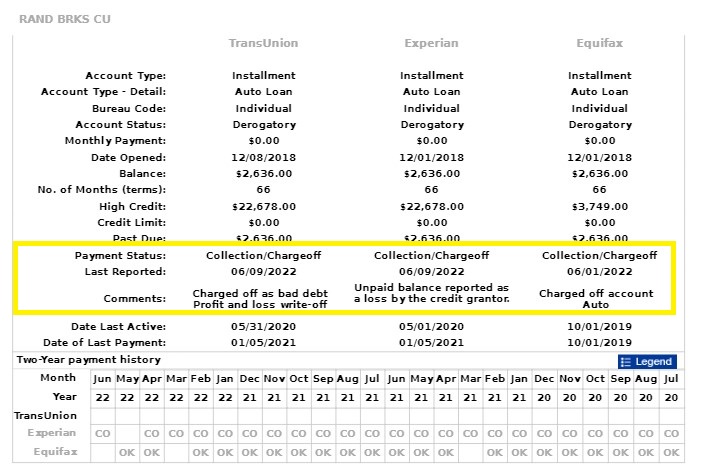

This account is an example of a Charged-Off Car Loan.

Remember... You have the LEGAL right to contest the VALIDITY of an account!

You can do this by requesting that the creditor provide proof of every document that they claim you AUTHORIZED or was PRESENTED to you.

So in order to dispute this account correctly...

You need to know the documents that are Legally Required to be Presented or Signed in the US State that the car was purchased in.

MOST states require the same documents, but if you want to know what documents are REQUIRED, you can easily call a local dealership and ask to talk to someone in the Finance Department.

So In TEXAS (where I'm from)...

A Dealership Presents you with the FOLLOWING DOCUMENTS:

- Law Contract (If you financed the vehicle)

- Buyers Order

- Trade-In Disclosure (If you Traded In a car)

- Credit Application (Dealership Copy If you financed vehicle)

- Credit Application (Lender Copy If you financed vehicle)

- Title Application (If title work done at Dealership)

- Power of Attorney (Usually only needed if you Traded in a Car)

- Credit Disclosure Form (If they pulled your credit)

- Receipt of any Down Payment Received

- Odometer Statement

- Agreement to Provide Insurance

- County Title Insurance

When creating your dispute letter, you will ask them to provide you with a copy of all relevant documents listed out.

Now onto the next part...

#2 The Resolution you want if Account is Not Verified

This part is easy...

After you ask them to provide you proof, you will tell them WHAT you expect them to do. An example statement would be:

"If you can't provide proof of ALL the listed documents, you are Legally Obligated to delete this account."

Now even though this is an example of how to dispute a Charge-Off or Repo Auto Loan (note there are several methods), this approach works for any account you can find on a credit report!

Late payments killing your scores?

Need more details on creating the PERFECT DISPUTE LETTER? Check out the full video here:

Sorry, your browser doesn't support embedded videos.

How to Create the PERFECT Dispute Letter

DIY (Do It Yourself) Credit Repair

Should you hire a Credit Repair Company?

I'll answer your question with a question...How serious are you about fixing your credit?

If you look at your credit like a car, credit repair would be the equivalent of changing your oil, but doing it each month consistently...talk about running smoothly!

Let's assume you know how to change your oil.

That's great! And if you're like my friend Jason, that sounds like a Saturday to look forward to!

Unfortunately, even if you do know how to do it, most people do not have the time to stay on top of it month after month (or you might not enjoy it as much as Jason).

The same time and effort goes into credit repair...

- Researching new ways to dispute (without getting blacklisted)

- Rushing to respond to the bureaus within the deadlines

- Ensuring you keep up with your balances

- Add new accounts without going over your inquiry limits

- Removing dispute comments (at the appropriate times)

- And so much more...

If the above list sounds invigorating and rouses your curiosity, then I encourage you to handle the challenge of repairing your credit yourself, you got this!

It's a LOT of tedious work, but can save you money in the end.

If you DO want to learn how to repair your credit on your own, but need guidance, our Repair It Yourself Guide walks you through the ENTIRE process.

Credit Repair Companies and Credit Repair Services

What does a Credit Repair Service offer me that I can't just do on my own?

Ah yes, the MILLION DOLLAR question!

You might not know, but credit repair doesn't have the greatest reputation. This is because a lot of companies in the industry are dubious at best, others can be total scams and take your money and you'll never hear from them again...

As for the rest, the average Credit Repair Company has only been in business for 7 Months.

Oof...

That means that experienced credit repair companies are fairly hard to come by...

If you find a professional team, that's been in the industry for multiple years, a high success rate, and a ton of great reviews, hold onto that gem because you'll save a lot of time and money trusting them to handle the process for you.

A truly experienced Credit Repair Company looks at credit reports and scores differently...

They know the laws and are able to look at your credit the way that Creditors and Credit Bureaus analyze it.

The qualified Credit Repair Company can also dispute using methods they know will get results...

In fact, sending out the initial disputes is easy compared to knowing how to respond when accounts DON'T get removed right away. Investing in a professional Credit Repair Company with True Expertise is worth every penny, every time.

If you are looking to hire a Credit Repair Company, it's vital that you interview the Company before you sign up with them and give them a single penny.

Here are the Top 8 Questions I recommend you Ask a Credit Repair Company Before Hiring them:

- Can you explain the dispute process in detail?

- How much do you charge on average for your services?

- Do you offer a money-back guarantee?

- Are you licensed and bonded?

- Do you dispute all my negative accounts all at once or how many do you dispute at a time?

- How long does the average client service take?

- Do you guarantee permanent results?

- Do you have any client testimonials you can share with me?

Fast Credit Repair Options

Just like most products and services today, people want a FAST Credit Repair Option. They want their credit fixed and they want their credit fixed NOW!

I get it. But the truth is, If you're sending Disputes via snail mail, there's no faster option than seeing results every 30-35 days. In fact, post-pandemic it's been closer to 45 days for many before receiving a response!

If you're truly looking for a Faster Dispute Option, faxing your Dispute Letters to the Credit Bureaus might actually be the speedier option you're looking for...

Ghislain & Marie David de Lossy/Getty Images

Ghislain & Marie David de Lossy/Getty Images

The catch is that due to the large amount of Disputes they receive, the Bureaus are constantly changing their Fax Numbers.

If you do want to send out your disputes via fax, the process of drafting up the actual dispute letters doesn't change, you will simply print and fax it instead of stuffing it in an envelope and sending it through the mail. And you'll save on a stamp.

To find the current fax numbers you can use Google, or simply call the Credit Bureaus and ask - just be prepared to sit on hold when you call.

Top Credit Repair Companies and Legitimate Credit Repair Companies

As I said previously, the average Credit Repair company has only been around for 7 months, plus the Industry as a whole has a fairly BAD reputation, unfortunately.

This makes it absolutely ESSENTIAL that you do your research before making a decision on who you're going to trust with your credit!

Once you can see why investing in a proven company is really the best way to go, you need to call around and use the questions in the "Credit Repair Companies and Credit Repair Services" section to find the company that best fits your needs.

If you're interested in using a Credit Repair Service, here is a Highly Recommended Credit Repair Company with an Outstanding Reputation you need to check out: Credit Repair Recommendation .

Credit Repair Cost

You work hard for your money. The whole purpose of investing in a Credit Repair company is to save money...

If you choose the wrong company for what you need, the results can be very costly and stressful.

Previously, I gave my Top 8 Questions I recommended you use to find the best company to fit your needs. Once you've found a handful of companies to choose from, you'll need to decide the fee structure that best fits your situation.

To better understand your options, I have outlined the 3 Most Common Fee Structures:

- Flat Fee Option

This is the option I recommend to most people. You pay only a flat fee for the company to dispute ALL of your derogatory accounts at the same time. A good company will usually be completed with your services in just a few months.

- Monthly Payment Option

Although this option has a lower upfront cost in most situations, it's not usually the least expensive option in the long run. And usually the company will not dispute all of your accounts at once, so the process can take 6-12 Months to complete.

- Pay for Deletion

Despite this option often being advertised as the least expensive option, that's not the case. Yes, they only bill you for the Accounts Removed, but the initial Down Payment along with Cost Per Deleted Item can actually end up being the most expensive of the 3 options.

Regardless of which option you choose, be sure to ask as many questions as you need to ensure you're clear on exactly what you're paying for throughout the service.

Also, make sure you Read the Agreement before you sign so you also understand precisely what you're agreeing to.

Pay Someone to Fix My Credit

Just because your best friend's uncle's cousin's neighbor fixed his own credit and has an 800 doesn't mean he has any idea what he's doing with yours.

If you do have "Someone" that can handle it, just make sure that "Someone" you're referring to is a company. Make sure that company is a registered business and is operating out of an actual business suite.

Also ensure that they are Licensed and Bonded in the state where they are doing business in and ask them to provide Proof (not all states require a license). If you want to look up if your state requires a bond, check out Bond State Requirements .

Lastly, my advice is to always Trust Your Intuition. If something doesn't feel right now, it's only going to get worse as the service progresses and you might not be able to get out of it.

Best Credit Fix

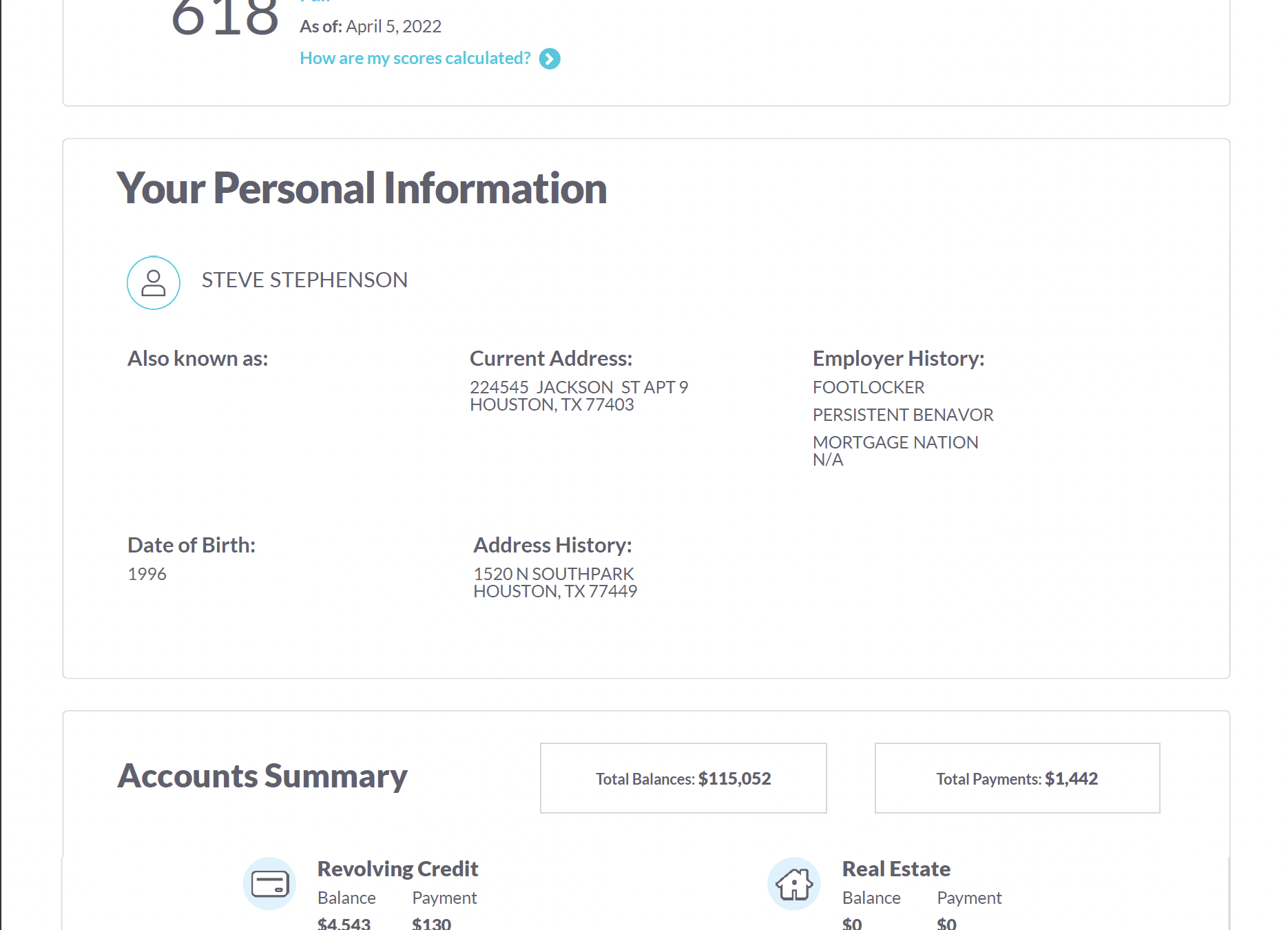

If you're looking for the Best Credit Fix, the best thing you can do is Access your Credit Report Online FREE and get familiar with your Personal Credit Situation.

If you have never looked over your Credit Report before OR you just need FREE Advice on How to Raise Your Credit Score, then you can get a FREE Credit Consultation from a Credit Repair Company.

It's important that during your consultation, the company goes through your entire Credit Report and explains how things are affecting your Overall Score. Some clients think they need Credit Repair when in fact, they don'tt, so a thorough consultation will give you a better idea of what your Credit needs.

Steps to Fix My Credit

When fixing your credit, it's important to understand the steps you need to take in order to do it effectively.

Whether it's you doing it on your own, or you hire someone to do it for you, here are the Best Steps to take when Fixing Your Credit:

- Pull your Credit Report online for FREE

- Look over your Credit Report and identify any Errors or Negative Items

- Request a FREE Consultation and Obtain Free Professional Advice

- Decide if you are going to Hire a Company or Do the Credit Repair Yourself .

- If writing Disputes yourself, draft up the Dispute Letters - make sure they are original and not copied from online sources

- Make sure to include your ID's and if you have proof an Account is Invalid, make sure to include this in your Disputes

- Mail out the Letters and wait 30-45 Days for you to get a response from the Credit Bureaus.

- Respond back to the Credit Bureaus, IF they did not resolve your Dispute or Respond back to your dispute.

- Rinse and Repeat. Make sure each time you respond with another Dispute Letter that you are CLEAR on your concern, Identify the Account in Reference, and Clarify what you want them to do.

Disputing on your own can be intimidating at first but it's like learning any new skill - it gets easier with practice.

Credit Repair Software

There are plenty of different Credit Repair Softwares available if you're looking to streamline the process, but they can be very expensive and not recommended if you're only looking to improve your own Credit Repair.

If you're looking to help others and it makes sense for you financially, then looking into a software that can help you quickly draft and print letters could be a good option.

Bonus #1 - Advanced Disputing Techniques

If you're deciding to do Credit Repair on your own, it's important that you are strategic with your approach.

I've mentioned in many of my Blog Posts and Education Books how VITAL it is to create your own Dispute Letters and only use ones found online as a reference. There is no problem taking small excerpts from different letters you find online, the best Dispute Letters are unique ones.

In order to help you jumpstart your SUCCESS in Disputing, I have put together a GUIDE.

I have been doing Credit Repair for the last 15 years and it has taken hundreds of trial and error Dispute Letters to get this process perfected. When Disputing, there are so many methods you will find online. In fact, a lot of "GURUS" will try to sell you their process for hundreds of dollars just to find out that the information is NO DIFFERENT than information you can find for FREE. Don't fall for the scheme and pay for these tactics. Let's talk specifics...

What information can you Dispute? Well you can dispute ANY information on your credit report. Most people think only Accounts can be disputed, but this is simply Not True.

Personal Information

When beginning disputes, it's VITAL that you remove any addresses off your Credit Report EXCEPT for your CURRENT Address.

If you have lived at your current address for an extended period of time and you have derogatory accounts on your Credit Report that are tied to that address, then this process may not work UNLESS you have a different address you can use and update to your Current Address.

If you are looking to UPDATE your Address, you will need to create a simple letter stating you want to update your current Address As "X" and you are requesting they remove ALL other Addresses off your Credit Report because you have no record of them. ("No record" can mean many things, so this wouldn't be untrue.)

If you are looking to REMOVE addresses off your Credit Report, then the most effective and fastest way to do this is to call each Credit Bureau. You would request that they remove the address(es) in question, as you have No Record of them and the Bureau is required to have accurate information On File.

Here are the most recently updated Phone Numbers for all three Credit Bureaus:

Experian: 888-397-3742Equifax: 888-378-4329TransUnion: 888-909-8872

Why is Removing Addresses important?

Well, in order for a Credit Bureau to deem an account Valid, must first verify that the address the original bill was sent to is Valid.

If you have removed any old addresses off your credit report it is much harder for them to Verify the account.

Remember a Credit Report must show ACCURATE and relevant information.

Negative Accounts

After you have confirmed that the Credit Bureaus have removed the addresses from your credit reports, it's important to obtain an UPDATED Credit Report Online for FREE and ensure the information is Updated on your Report. Keep in mind that the Credit Bureaus can take up to 30 days to update this information. It's time to cover the Different Types of Negative Accounts and best p ractices to remove them.

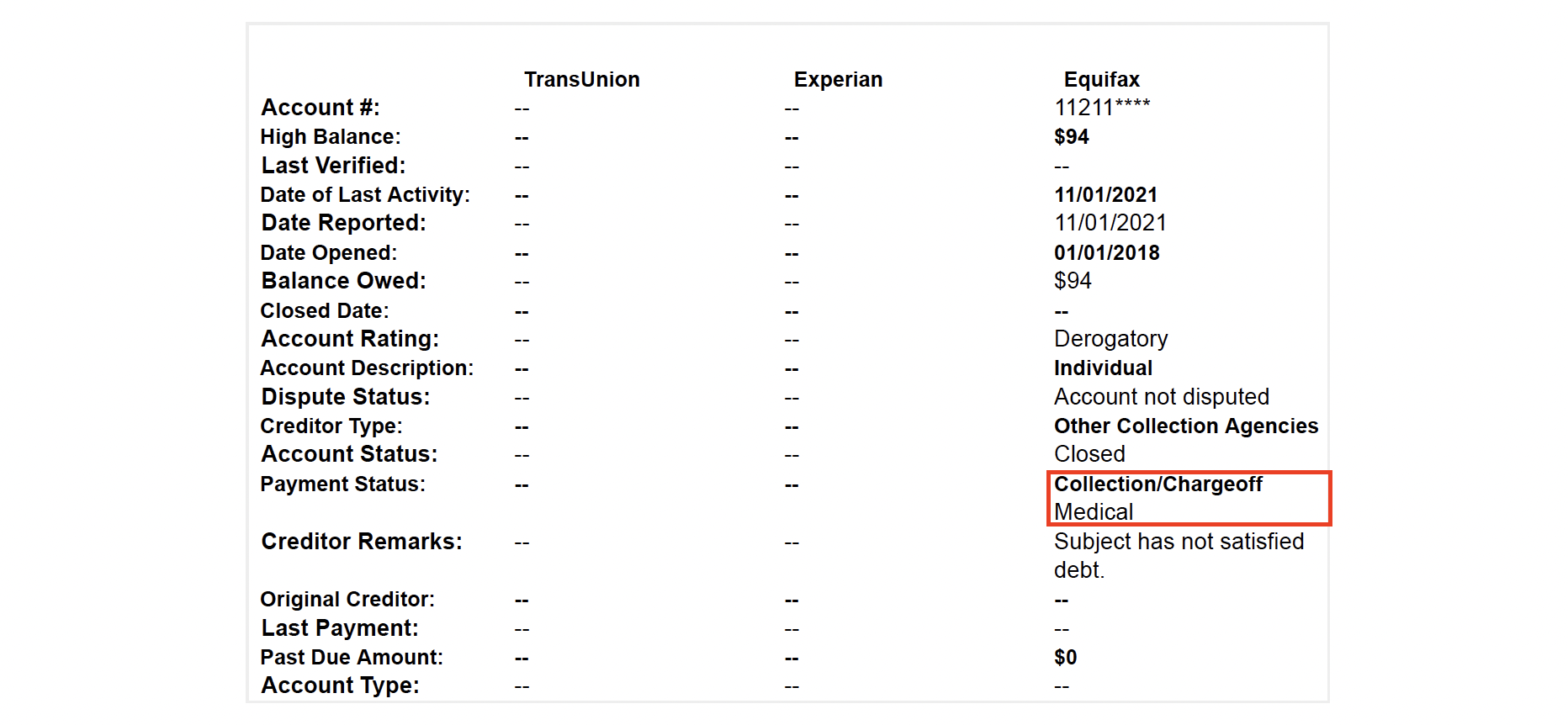

Medical Collections

Medical Collections are (usually) the simplest type of account to Dispute and get Results. This is because the debt is difficult to validate and therefore easy to remove.

The Credit Bureaus have recently agreed to remove any Paid Collections off Credit Reports, so you will no longer see these on your Credit Reports starting July 2022. Any Unpaid Medical debt in Collections will not report to your credit report for an entire year, and ANY Medical Collection under $500 will not report to your credit report AT ALL. Okay, good news! But what's the best method to dispute Medical Collections? Easy. The most EFFECTIVE method is the Validation Method. This method requires the Credit Bureaus to provide Evidence of the Debt or it is removed off the Credit Report. Most collection agencies who collect on Medical Debt KNOW they usually don'tt have the required documentation to Validate the Debt, so they won't put up much of a fight before going ahead and removing it.

Here's how to Remove Medical Collections...

First you need to know what documents are REQUIRED to show Proof of a Medical Debt .

They are as follows:

New Patient Information Intake Form - This is the Form you fill out when you go to the doctor that contains all of your personal Information.

Medical History Form - This is the form you fill out regarding Your Medical History, Allergies, etc.

Notice of Privacy Practices Form - This is essentially a Release F orm of who y ou authorize sharing your information with.

Acknowledgement of Financial Responsibility - This Form explains you have a Financial Responsibility if you do not have Insurance or if the Insurance Company refuses to pay.

HIPAA Compliance Patient Consent Form - This Form is mandatory for anyone offering Medical Services to show they protect your Privacy.

Medical Services Agreement - This document will explain their Policies and Procedures. Physician Patient Arbitration Agreement - This is not required by all States, but it's important to ask for it anyway. This basically will disclose procedures to follow in case of Malpractice.

Itemized Doctor Bill - This will show ALL medical services performed and the corresponding costs.

Okay, so now that you know what Forms are required, you will create a SIMPLE Dispute Letter requesting the Credit Bureau validate the Account by providing Proof of the listed documents. Being specific on what you're requesting is ALWAYS important to demonstrate to the Credit Bureaus and Collection Agency that you are on top of your game!

Non-Medical Collections

Any Collection on your Credit Report will have an "Original Creditor." This is because your debt can be, and might have been, sold to a Collections Agency.

Some common Accounts that are sold to Collection Agencies are:

- Utility Accounts

- Cell Phone Accounts

- Credit Card Accounts

- Furniture/Appliances

The best way to Request Validation on these Accounts is to compile a list of the Documents you were presented with at the beginning and after the sale of the Item, before requesting the credit bureaus provide you proof of all the documents. In order to find out which documents are usually provided, check to see if you have a similar Account open currently, or try to reapply (WITHOUT submitting the Application) online or in-person to see which documents are provided.

Charge-Offs

Depending on the Charge-Off, you will use the SAME procedure as we did for Medical Collections. In order to successfully remove items from your Credit Report, you need to understand the different Documents that were provided for ANY type of debt, then use that knowledge to ask for proof of them.

Let's go through the Different Documents for each Type of Charge-Off you could come across on your Credit Report.

Credit Card Charge-Offs

Credit Card Application - Application that was filled out in-person or online.

Rates and Fees Sheet - This will disclose all Fees and Interest Rates for the Credit Card.

Credit Card Application Disclosure - This outlines all of the fees, costs, interest rates, and terms that a customer could experience while using the credit card.

Privacy Notice - Not required in all states, but something you should always ask for regardless.

Copy of Last Billing Statement - This is the same as a monthly Billing Statement.

Detailed Break Down of Interest Paid - This document will show all interest added and Payments Made since l ast billing statement.

Debt Collector Communication Disclosure - Statement showing the debt was sold to A Debt Collector

You will use the same process when setting up the Dispute Letter for a credit card Charge Off and request they validate the debt by sending you Proof of the listed Documents above.

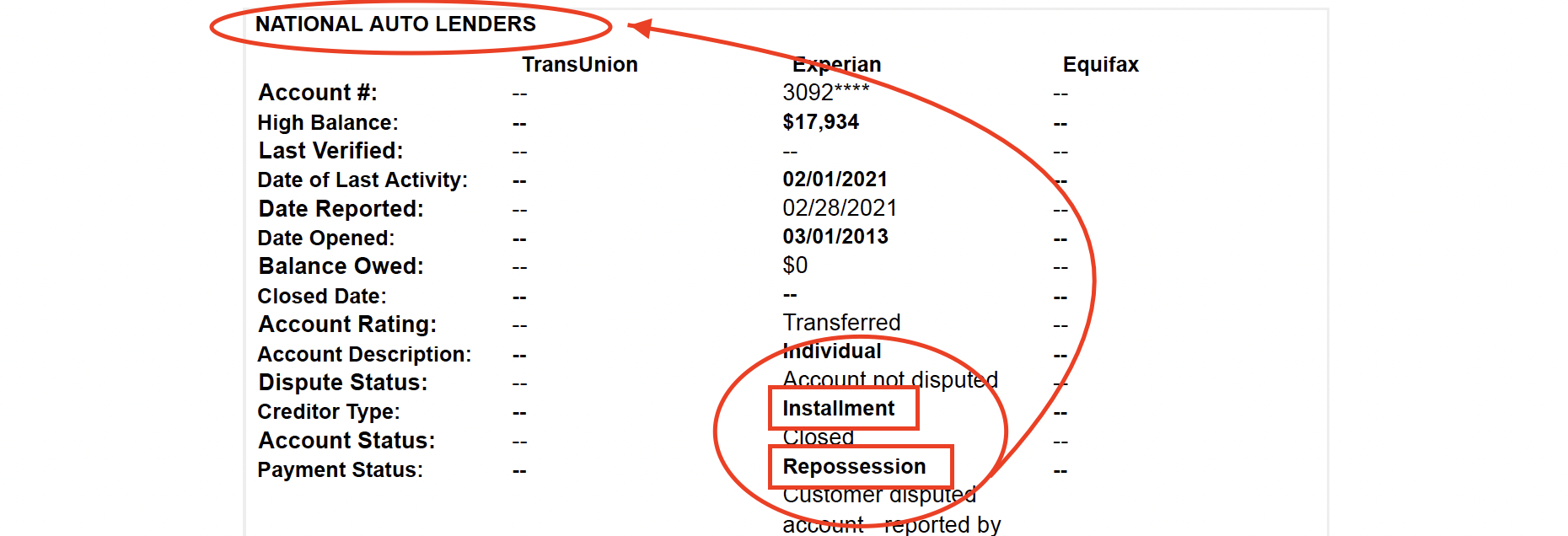

Charge - Off Auto Loan or Repossession

There are 3 Different Methods when disputing Auto Loan Charge-Offs/Repossessions. Based on your situation, you can decide which method will work best for you.

1. Validation Method (can be used for Charge-Offs and Repos)

Similar to disputing Medical Collections and Credit Card Charge-Offs, you must know what items are required when Disputing an Auto.

The following Documents are ones you can request that the Creditor would need to provide in order to Validate the Debt. Law Contract (if You financed the vehicle) :

- Buyers Order

- Trade-In Disclosure (If you Traded in a car)

- Credit Application (Dealership Copy If you financed vehicle)

- Credit Application (Lender Copy If you financed vehicle)

- Title Application (If title work done at Dealership)

- Power Of Attorney (Usually only needed if you Traded in a Car)

- Credit Disclosure Form (If they pulled your credit)

- Receipt of any Down Payment Received

- Odometer Statement

- Agreement to Provide Insurance

- County Title Insurance

For Repossessions, you should also include a Request for the following documents:

- Bill of Sale from the auction detailing the Sale Price and Fees associated with the transaction.

- Proof the vehicle was Repossessed by towing company

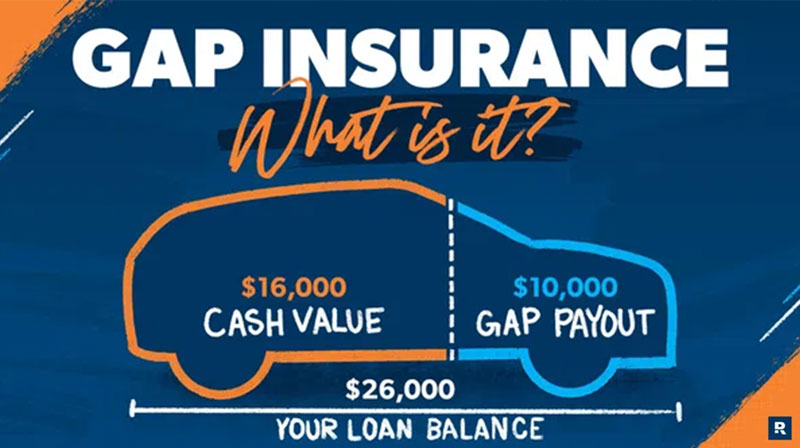

2. Gap Insurance Method - (will work if Vehicle had Gap Insurance)

Ramsey Solutions

Ramsey Solutions

This method is specific and effective. You must provide proof that the vehicle had Gap Insurance, if you do not have a copy of this document, you can contact the Dealership where it was purchased and request a copy.

Once obtained, you can use this copy as proof and supply it to the Credit Bureaus. Let them know your Gap Insurance refund was never applied to the Balance and you are formally requesting proof that it was, or that they delete the account due to a Reporting Error. To clarify, anytime a vehicle loan is terminated, the gap insurance company is alerted and they pro-rate the remaining policy and cut a refund check to the Creditor of the vehicle. This amount HAS to be applied to the Loan Balance and in most cases it's NOT.

Making sure you enclose Proof of the Gap Insurance Policy is KEY to ensuring this method is successful!

3. Credit Sale Strategy (can be used for Charge-Offs and Repos)

If you purchased a vehicle from a Car Dealership and on your Credit Report it is reported as an "Installment Loan" then this is INVALID.

You should dispute this Account by stating "This account is being reported as an Installment Loan which is Factually Incorrect. The true account type for this account is a "Credit Sale Agreement." Please remove this account from my credit report immediately."

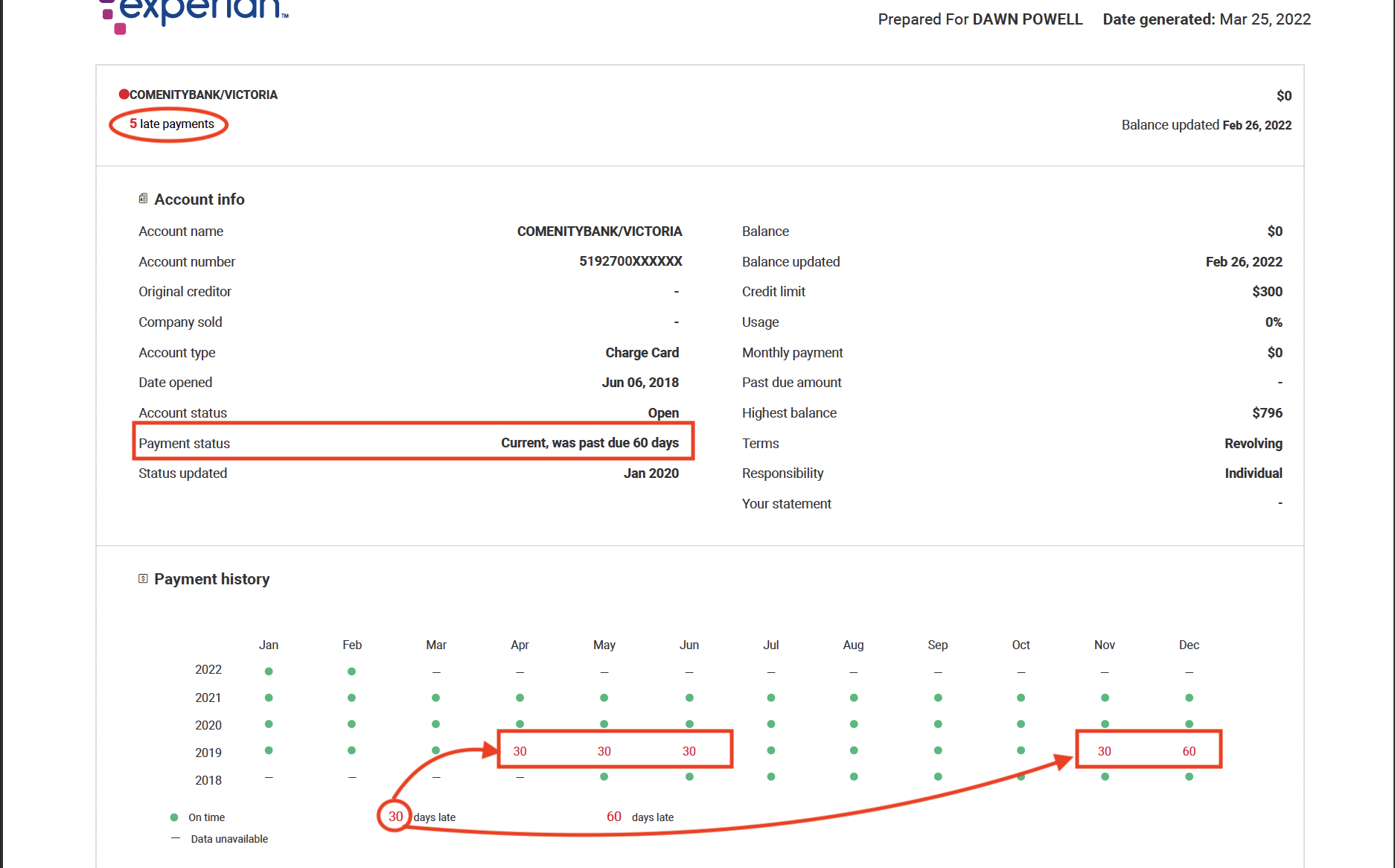

4. Charge-Off with Late Payment Method (if the account is still reporting Late)

If you have any Account in a Charge-off, Collection, or Repossession Status and it's still reporting as "Late", then this is an FCRA Violation and you can Dispute it.

This method is fairly straightforward. I recommend taking a screenshot of the Account on your Credit Report and writing the following statement in your Dispute Letter: "You are reporting this account as a (Charge-Off, Repossession, Collection), as well as continuing to report this account as Late. Since this account is no longer Active and is Closed, it is impossible for me to still be in default on this Account. Due to this Reporting Violation, I am requesting you delete this Account immediately."

Late Payments

Read my Personal Guide on How to REMOVE LATE PAYMENTS like the PROS

Late Payments can be the MOST DIFFICULT type of derogatory item to remove UNLESS it's a reporting error. If this is the case, you will provide proof of the Error and request the Bureau delete the Account.

For Late Payments there are 3 Methods you can use, BUT one of the methods Is VERY Effective and not something you can find easily online.

Let me explain... We'll go through all 3 Methods from least to most effective...

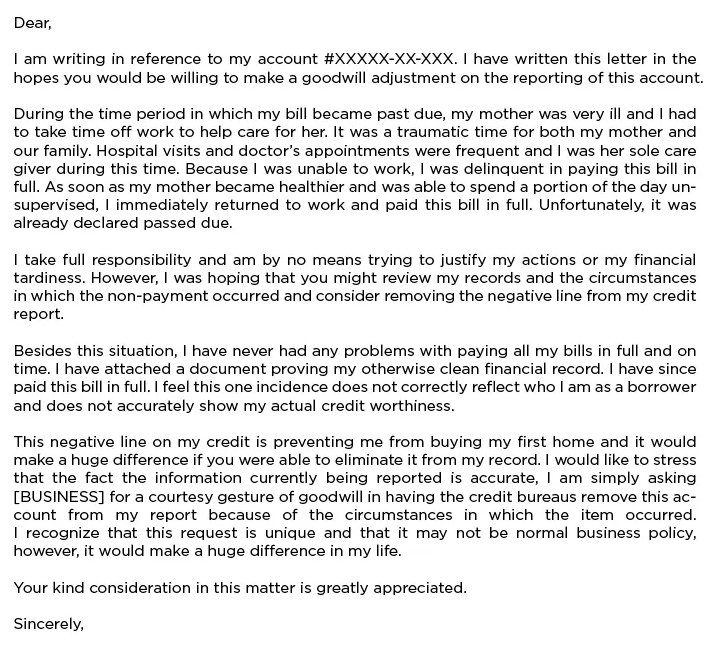

Late Payment Method #1 - The Goodwill Dispute

This method worked like a CHARM...10 Years Ago!!

Since then, it's been OVERUSED. It's not an effective approach anymore because most Credit Bureaus and frontline Creditors do not look at these disputes with any empathy. However, if you're going to utilize this type of dispute and you want to be More Effective, I have one small change to this process that will help significantly. Let's go through The Process...

A Goodwill Dispute is when you ask the bureau to remove the Late Payment because it was an honest mistake of some variety. You could have been sick, laid-off, financially struggling at that point, or even just had a disorganized moment and truly forgot.

The goal is that the person reading the Dispute will understand and have empathy for your situation.

Instead of writing this Dispute to the Credit Bureaus or Creditors, you're going to personalize it and write a Letter to each "Leader" of the company individually. The GOAL here is for your letter to somehow reach a sympathetic Decision Maker with more control.

To get the list of leaders for most companies you need to Google "Leadership" followed by the company name. For example, Google "Leadership Chase Bank" and see if you find a Leadership page with the information you need. If it's a smaller Company, adjust the method to instead search the company name followed by a top Leadership Title, i.e. "Shell Federal Credit Union CEO." Once you've found what you need, this includes the mailing address of their Office, you'll then mail them a letter fully explaining your situation. Tell them why you were late, express your remorse, and explain to them how this late payment has affected your credit and long-term Goals. Let them know it would be a HUGE Favor if they removed the Late Payments and don'tt forget to thank them for their time and consideration. Send this letter out to as many "Leaders" that you're able to in order to increase your chances of getting the desired result. The more Leaders you can reach, the better the result will be.

Late Payment Method #2 - The Validation Dispute

This Dispute Process is similar to ALL the other processes we have covered in this article, except instead of requesting Validation on the Account itself, you will be requesting Validation on the Late Payments.

Common Documents you can request Validation on are:

Ledger Balance -Showing each transaction made in the last 90 days, the payments you have made, and details of any interest added.

Payment Transactions - This will be a list of all the payments you have made within the last 6 months. Make sure to request a transaction receipt.

Provide Proof of Active Transaction Disputes - Make them provide proof of any Disputes you have on Transactions you have recently made.

Provide Proof of Change of Address - Request to see proof of receipt of this.

Rates and Fees Sheet - If the current rate of Interest being paid doesn't add up and the Balance shown is incorrect, it can be Disputed.

Something to take note of, when it comes to Late Payments, you are NOT trying to have the entire Account removed off your credit report, instead you are trying to only have the Late Payments removed. So make sure that after requesting these documents you state the resolution you're looking for is that ANY and ALL Late Payments to be Removed. Something that is usually effective is an Either/Or statement.

You will indicate the Account in reference, list the documents you are requesting proof of, in order to validate the reporting of the account, then state "OR you can correct the reporting and Remove the Late Payments, and this will satisfy my concern."

With the Either/Or statement, you need to be sure it's worded politely and doesn't show your only intention is to bully them to get late payments removed.

You'll catch more flies with honey, as the saying goes...

Not interested in doing this on your own?

Feel free to check out ASAP Credit Repair, they streamline the process so you can sit back and RELAX!

Method # 3 - Email the CEO

The MOST SUCCESSFUL METHOD (in my opinion) is to contact the CEO of the Company DIRECTLY and ask for them to remove the Late Payment. This method is so effective simply because not many people are using it. If you're looking to get Credit Repair results quickly, NOW is your time to take this approach. Just like Goodwill Dispute letters, this will become less effective the more people make use of it. But why is this method so effective?

Well, firstly, it allows you to bypass all the pesky gatekeepers and head straight for the Top. Also, most CEO's do NOT want to ignore a client concern like this and will instruct that their Admin do whatever is needed to ensure your case is resolved satisfactorily.

Here are the 5 Steps to apply this effective Email Method:

- Find out who the CEO/President is of the Company.

- Search their name on Google, followed by "Email".

- Draft up an email using your personal account that summarizes your situation. Ask if they would kindly help you by removing the late payment. It's BEST to explain your story and your desired resolution moving forward if they can remove the late payment(s).

- Make sure to include your information and the account information.

- Send and wait patiently!

Normally the creditor will call you directly instead of emailing back and forth, so be sure to answer the phone!

Bonus #2 - Do I NEED Credit Repair?

We have put together a FREE guide where you can quickly determine if you are truly in need of Credit Repair.

Thousands of people every year are taken advantage of by a shady Credit Repair company simply because they didn't do their own research to determine if they actually needed Credit Repair or not.

Don't wonder, read the FREE GUIDE below!

FREE Guide on Determining if you NEED Credit Repair!

Conclusion

As you can see, this in-depth and fully comprehensive Guide to Credit Repair REALLY WORKS, but before you get started on your Credit Repair checklist, I'd love to hear from you!

What did you think of today's post?

Or maybe you have a question about something you read...

Let me know by leaving a comment below.

Thanks,

Joe